In today’s mortgage landscape, not all borrowers fit the traditional mold of W-2 employees with straightforward income documentation. Many hardworking professionals—entrepreneurs, freelancers, consultants, and business owners—find that their income doesn’t show clearly on paper, even though they’re financially strong. That’s where SIVA loans come in. Short for Stated Income, Verified Assets, the SIVA loan is a flexible mortgage solution designed specifically for self-employed individuals and others with non-traditional income.

At Starr Mortgage Company, we understand that your financial story can’t always be summarized by a paycheck stub. Our suite of programs, including Interest Only Mortgage Loans, Foreign National Loans, and Condo Hotel Financing (Condo-Tel), ensures that every borrower has access to the right financing tool for their needs. In this blog, we’ll explore what a SIVA loan is, how it works, who qualifies, and how it can help self-employed borrowers achieve homeownership.

What Is an Alternative Income Verification Loan?

An Alternative Income Verification Loan is a mortgage that allows borrowers to qualify based on financial documentation other than traditional tax returns or W-2s. These loans were created for people whose income fluctuates or doesn’t fit neatly into standard underwriting boxes. Instead of focusing solely on reported income, lenders assess the borrower’s broader financial picture, including assets, bank statements, or business earnings.

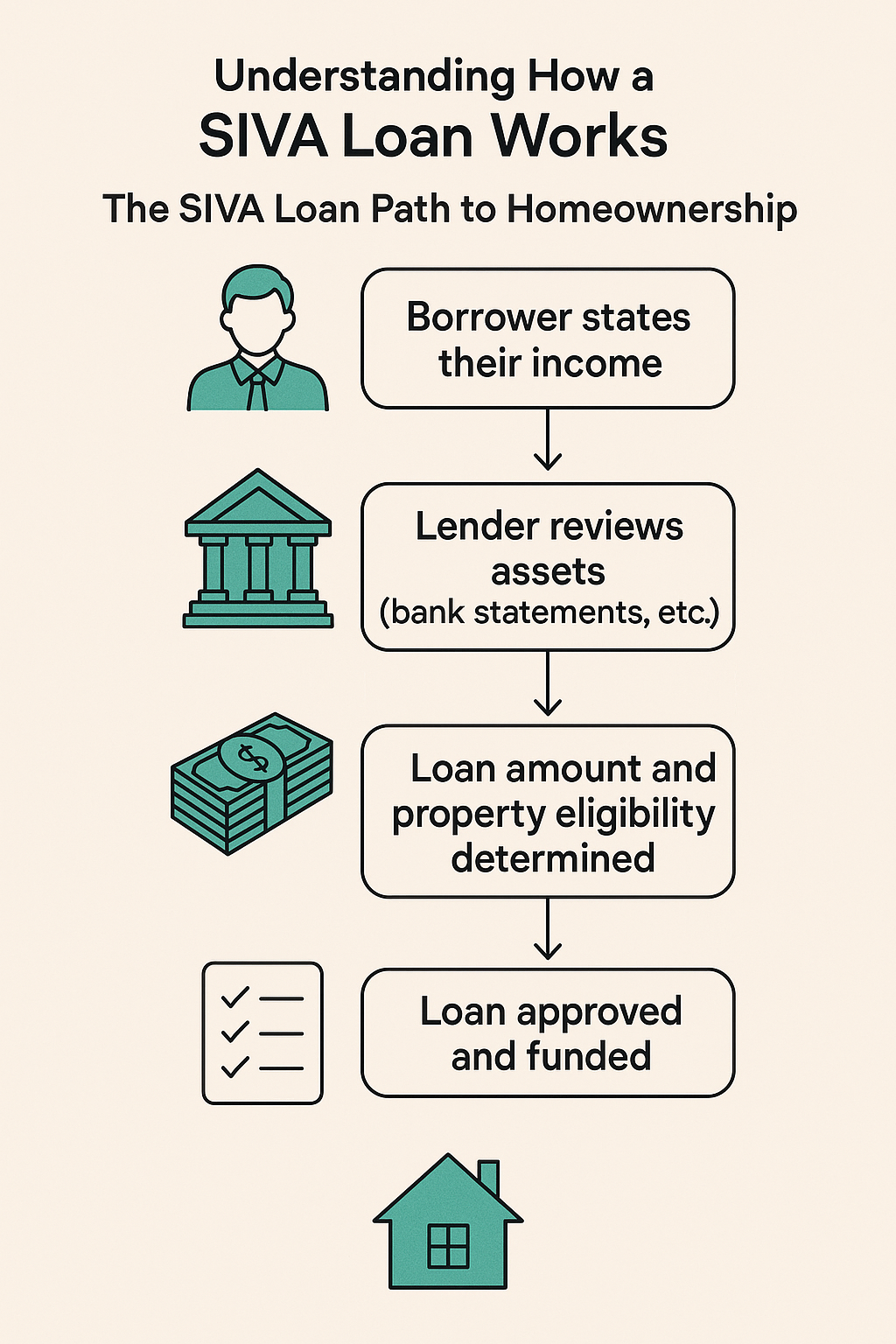

A SIVA loan falls under this category. The key concept behind a SIVA loan is flexibility—borrowers “state” their income without providing conventional proof, while the lender “verifies” that they have sufficient assets (see infographic below) to support the loan. This approach balances convenience with responsible lending.

How Does a SIVA Loan Work?

When applying for a SIVA loan, borrowers don’t have to provide traditional income verification documents like pay stubs or tax returns. Instead, they disclose their income, and the lender verifies their financial stability through assets such as:

- Bank accounts

- Investment portfolios

- Business ownership equity

- Retirement funds

This verification ensures the borrower can comfortably make their mortgage payments. For self-employed borrowers who reinvest heavily in their businesses or show lower taxable income, a SIVA loan can make homeownership attainable without compromising financial transparency.

Types of Alternative Income Loans

At Starr Mortgage Company, we offer a variety of programs to serve diverse financial profiles. While SIVA loans are one of the most popular among self-employed individuals, other alternative income loan options include:

- Bank Statement Loans – Borrowers qualify based on 12 to 24 months of personal or business bank statements instead of tax returns.

- Asset Depletion Loans – Lenders consider the borrower’s assets and convert them into a qualifying income stream.

- Interest Only Mortgage Loans – Perfect for those who want lower initial payments, paying only interest for the first few years.

- Foreign National Loans – Tailored for international clients seeking to invest in U.S. property without U.S. income documentation.

- Condo Hotel Financing (Condo-Tel) – Specialized funding for unique properties that often don’t meet conventional lending criteria.

Each of these programs, including the SIVA loan, is designed to provide flexibility and opportunity for those who might otherwise face roadblocks in securing financing.

Who Can Benefit from an Alternative Income Verification Loan?

SIVA loans and other alternative income verification products are ideal for borrowers with complex or variable income structures. These include:

- Self-Employed Borrowers: Entrepreneurs or small business owners whose tax returns understate actual cash flow.

- Freelancers and Independent Contractors: Those working in the gig economy with multiple income sources.

- Commission-Based Professionals: Real estate agents, consultants, and sales professionals with irregular income patterns.

- Investors and High-Net-Worth Individuals: Borrowers who have substantial assets but low reported income.

- Foreign Nationals: Individuals with overseas income or investments seeking U.S. property financing.

For many of these borrowers, a SIVA loan can be the bridge between financial success and homeownership. It recognizes that a person’s true ability to repay isn’t always reflected in their tax returns.

To learn more about these options and how Starr Mortgage Company can tailor a solution for your situation, visit our website at https://starrmortgagecompany.com/contact-us/ or connect with us on LinkedIn for mortgage insights and updates.

Who Can Qualify and How?

Qualifying for a SIVA loan involves meeting a few key requirements, though they are more flexible than traditional mortgage standards. Here’s what lenders typically look for:

- Good Credit History: A strong credit profile helps establish trust and compensates for limited income verification.

- Verifiable Assets: Liquid assets such as savings, investment accounts, or business funds that demonstrate repayment capacity.

- Stable Employment or Business: Proof that the borrower has a consistent source of income, even if unconventional.

- Reasonable Debt-to-Income Ratio (DTI): While more lenient than conventional loans, DTI still plays a role in assessing affordability.

- Property Type and Loan Amount: The property must meet lending standards and align with the borrower’s stated financial capacity.

With these factors, lenders determine the borrower’s ability to sustain mortgage payments responsibly. The SIVA loan process is faster and simpler than full-documentation loans, often closing in a shorter timeframe.

For professionals who rely on flexible financial structures, this approach can be life-changing. Instead of being penalized for self-employment or tax deductions, borrowers are recognized for their overall financial health.

Why Self-Employed Borrowers Choose SIVA Loans

Self-employed individuals often face challenges when applying for conventional mortgages because their income may appear inconsistent or lower due to business expenses. The SIVA loan eliminates these barriers by focusing on assets rather than strict income documentation.

A SIVA loan offers:

- Flexibility: Use assets instead of tax forms.

- Speed: Streamlined underwriting process.

- Privacy: Limited documentation means greater confidentiality.

- Accessibility: Ideal for entrepreneurs, consultants, and professionals with irregular income.

For example, if you own a business that reinvests profits or operates seasonally, your tax returns might not accurately reflect your financial strength. A SIVA loan allows you to demonstrate that you have the means to repay, without being penalized for using standard business deductions.

Stay connected with us on Facebook and X (formerly Twitter) to learn how real borrowers like you have successfully used SIVA loans to achieve their homeownership goals.

The Starr Mortgage Advantage

Starr Mortgage Company specializes in personalized lending solutions for clients who need flexibility and expertise. Our services go beyond SIVA loans to include:

- Interest Only Mortgage Loans

- Foreign National Loans

- Condo Hotel Financing (Condo-Tel)

- Featured Mortgage Programs designed for every borrower type

We’ve built our reputation on integrity, transparency, and dedication to helping every client find the mortgage that fits their unique situation. Whether you’re a business owner, investor, or international buyer, we’re here to simplify the mortgage process.

Read reviews from satisfied borrowers on our Yelp page and discover why Starr Mortgage Company is one of the most trusted names in the industry.

Don’t Let Traditional Lending Hold You Back

If you’re self-employed and ready to explore the power of a SIVA loan, don’t let traditional lending standards hold you back. Contact Starr Mortgage Company today to discover how we can help you qualify for a mortgage that matches your true financial picture.

Call us: 845-348-3172

Email: [email protected]

Contact form: https://starrmortgagecompany.com/contact-us/Follow us on LinkedIn, Facebook, X, and Yelp for ongoing mortgage insights, updates, and success stories.