Not every borrower fits the traditional mortgage mold. If you’re self-employed, retired, or have a non-traditional income stream, qualifying for a standard loan that requires W-2s, pay stubs, and tax returns can be frustrating—if not impossible. That’s where personal loan no income verification programs come in.

At Starr Mortgage Company, we specialize in alternative mortgage programs, often called non-qualified mortgages or low-doc loans. These options rely on alternative documentation to show your ability to repay, opening the door to homeownership for those who might otherwise be left out.

Understanding Personal Loan No Income Verification Options

A personal loan no income verification doesn’t mean lenders skip all due diligence—it means they verify your financial health using different methods. These loans are designed for borrowers whose income isn’t easily captured through traditional means.

Instead of W-2s or pay stubs, lenders may rely on:

1. Bank Statement Loans (SIVA: Stated Income, Verified Assets)

With a bank statement loan, lenders review 12–24 months of your personal or business bank statements. They look for consistent deposits to demonstrate your income. This is ideal for self-employed borrowers, freelancers, or business owners whose reported taxable income might be reduced by deductions, but who still have steady cash flow.

For example, a freelance graphic designer may have fluctuating monthly income that doesn’t fit neatly into a standard underwriting box. With a bank statement loan, their deposits—not just tax returns—show the reality of their earnings.

2. Asset-Based Loans (NIVA: No Income, Verified Assets)

If you have significant savings, investments, or retirement accounts but no steady paycheck, a NIVA loan may be the right fit. These loans rely on the strength of your assets to prove repayment ability.

This is particularly beneficial for retirees or high-net-worth individuals living off investments. Even without regular employment income, their asset base offers lenders the confidence they need.

3. Rental Income Loans (NINA: No Income, No Assets)

For real estate investors, NINA loans allow projected rental income from the property to serve as the repayment source. This approach is common when purchasing income-producing real estate where the property itself can generate enough income to cover mortgage payments.

Investors can expand their portfolios without needing to document traditional income or liquid assets—making personal loan no income verification especially appealing in the investment world.

Potential Advantages of Personal Loan No Income Verification Programs

Access for Non-Traditional Earners

These loans open doors for those who may be excluded from conventional financing—self-employed professionals, gig economy workers, entrepreneurs, and those with complex tax returns.

Someone with strong business cash flow but irregular paychecks can qualify based on real financial health rather than rigid paperwork standards.

Flexibility for Varied Financial Situations

Whether you’re a retiree with a large investment portfolio, a business owner reinvesting profits, or someone living off rental income, personal loan no income verification programs adapt to your circumstances rather than forcing you into a one-size-fits-all model.

You can learn more about how Starr Mortgage helps non-traditional borrowers by visiting our LinkedIn page.

Faster Approval in Some Cases

Without the mountain of standard documentation, the application process can sometimes move faster. While underwriting is still thorough, the streamlined paperwork requirements may speed things along—especially helpful if you need to close on a property quickly.

Potential Drawbacks to Consider

While these programs are powerful tools, they also come with trade-offs. Understanding them helps you make an informed decision.

Higher Interest Rates

Lenders view personal loan no income verification loans as higher risk, so interest rates tend to be higher than those for conventional mortgages. The exact rate will depend on your credit profile, assets, and overall financial situation.

Larger Down Payments

Expect to bring more money to the table—often 20% or more—compared to the lower down payment options available with traditional mortgages. This upfront investment reduces risk for lenders and can be a hurdle for some borrowers.

Stricter Requirements in Other Areas

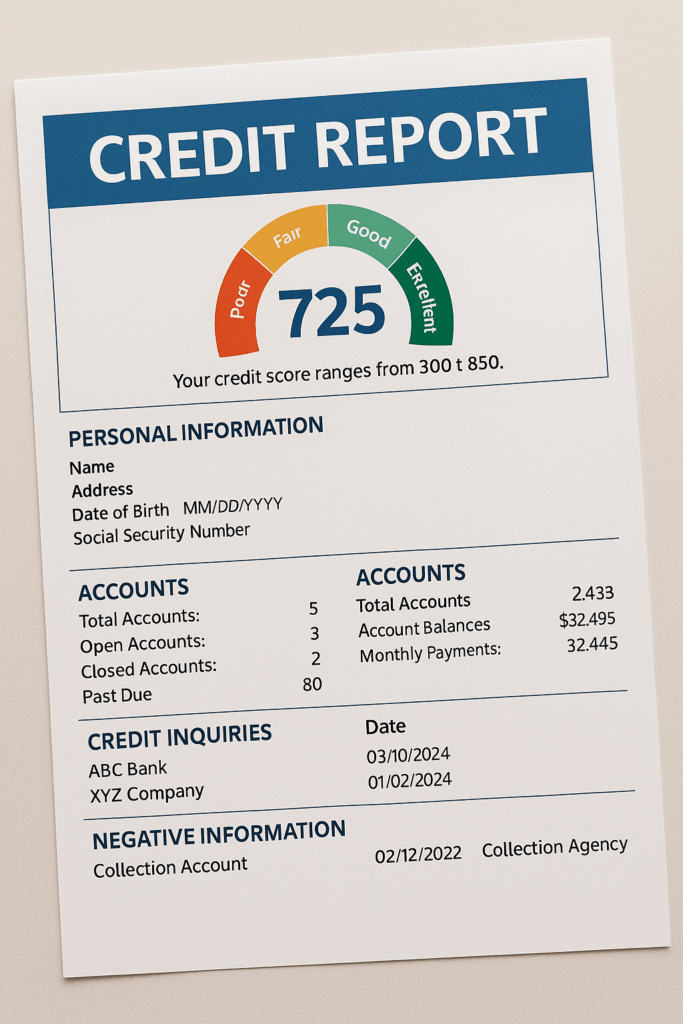

While income documentation may be more flexible, lenders still require strong credit (often 700+ FICO) and may insist on significant cash reserves. They want assurance that you can weather financial fluctuations without defaulting on the loan.

For tips on how to prepare financially, check our X profile where we share expert mortgage insights.

Who Can Benefit Most from Personal Loan No Income Verification?

While anyone who meets the lender’s requirements can apply, these loans are particularly beneficial for:

- Self-employed professionals with fluctuating or deductible-heavy incomes

- Freelancers and gig workers in industries like design, consulting, or rideshare driving

- Retirees living off assets rather than employment income

- Real estate investors using rental income to qualify

- Business owners reinvesting profits back into their companies

By focusing on your real financial resources—whether that’s cash flow, assets, or property income—these programs make homeownership and investment more accessible.

How Starr Mortgage Company Supports Borrowers

At Starr Mortgage Company, we have decades of experience guiding clients through specialized loan programs, including personal loan no income verification options. Our team understands that every borrower’s situation is unique, and we work closely with you to match your goals with the right loan structure.

We’ve built relationships with lenders who specialize in alternative documentation loans, so we can offer competitive options and explain every step in clear terms. We also help you prepare documentation—whether that’s gathering bank statements, asset reports, or rental income projections—so your application is as strong as possible.

You can read real client feedback about our process on our Yelp page.

Steps to Applying for a Personal Loan No Income Verification

- Initial Consultation – We discuss your goals, property plans, and financial situation.

- Document Review – Instead of pay stubs, we gather your alternative documentation such as bank statements or asset reports.

- Loan Matching – We identify lenders and products that fit your profile.

- Application Submission – We prepare and submit your application for lender review.

- Approval & Closing – Once approved, we guide you through closing and ensure all terms are clear.

Our Facebook page often features borrower success stories to inspire those starting their journey.

Let Starr Mortgage Help You Qualify Today

If you’ve been turned down for a traditional mortgage, that doesn’t have to be the end of your homeownership or investment goals. With personal loan no income verification options, Starr Mortgage Company can help you explore alternative financing paths tailored to your unique situation.

Contact Information:

- Phone: 845-348-3172

- Email: [email protected]

- Contact Page: https://starrmortgagecompany.com/contact-us/

Whether you’re self-employed, retired, or investing in rental properties, our team will work tirelessly to find a solution that meets your needs. Call us today to start your application and discover how our expertise in personal loan no income verification programs can turn your goals into reality.