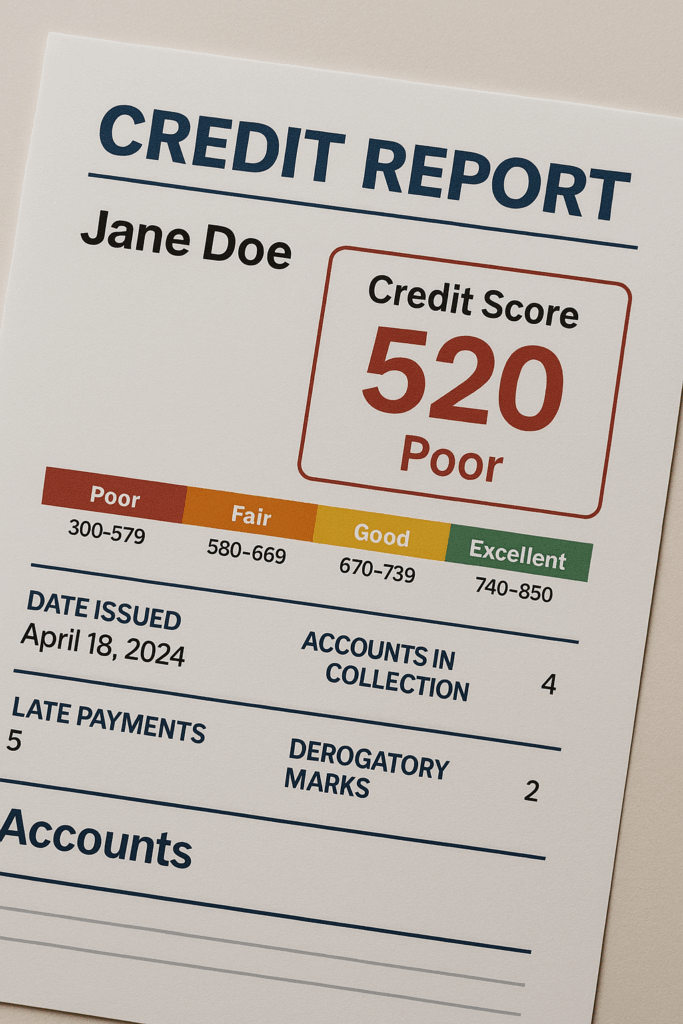

Did you know that approximately 16% of Americans have credit scores below 580, according to Experian’s State of Credit 2024 report? For many, this feels like an insurmountable barrier to homeownership. But the truth is, having less-than-perfect credit does not have to be the end of your dream to own a home.

At Starr Mortgage Company, we believe everyone deserves a chance at homeownership — regardless of their credit history. As a trusted mortgage broker and direct lender, we specialize in connecting clients with the right mortgage lender for bad credit situations. Our mission is to provide solutions, not roadblocks, for families who want to put down roots.

In this guide, we’ll answer your biggest questions about getting a mortgage with bad credit, explore how a mortgage lender for bad credit can work for you, and show you how Starr Mortgage Company can make the dream of homeownership possible.

Can I Get a Mortgage if I Have Bad Credit?

This is the first and most important question. The answer is yes, you can get approved for a mortgage with bad credit — but you need to work with a specialized mortgage lender for bad credit who understands your unique situation.

Traditional banks often have strict lending standards that shut the door on applicants with credit scores below 620. But at Starr Mortgage Company, we know life happens: medical bills, job loss, or unexpected events can drag down your credit score. Our role as a broker and mortgage lender for bad credit means we have access to programs that traditional banks don’t. We work with lenders who accept scores as low as 500 and help you understand what steps to take to qualify.

The key is preparation and guidance. We’ll help you review your credit report, find errors to dispute, and offer clear steps to strengthen your application. You’re not alone in this process — Starr Mortgage Company stands beside you every step of the way.

Mortgage Lenders Who Accept Bad Credit

Not every lender is willing to take on risk. But that’s where partnering with a mortgage lender for bad credit makes all the difference. Specialized lenders look at the bigger picture: your income, your job stability, and how much you can afford to pay monthly.

At Starr Mortgage Company, we maintain strong relationships with a wide network of lenders who work specifically with clients who have past credit challenges. We can match you with options like:

- FHA Loans: Backed by the Federal Housing Administration, these loans are designed for buyers with lower credit scores and require smaller down payments.

- Subprime Mortgages: For buyers with severely damaged credit, these loans provide a path forward with flexible requirements.

- Non-QM Loans: These non-qualified mortgages don’t fit traditional guidelines but open doors for self-employed borrowers or those with unique income situations.

A reputable mortgage lender for bad credit should never charge excessive fees or push you into a loan you can’t afford. That’s why Starr Mortgage Company carefully vets each lender and walks you through the fine print, ensuring your new mortgage is a stepping stone, not a burden.

What is the Mortgage Rate for Someone with Bad Credit?

It’s true: if you have bad credit, you will likely pay a higher mortgage rate than someone with excellent credit. Rates vary widely, but in general, the lower your credit score, the higher the interest rate — because the lender is taking on more risk.

For example, while a borrower with a 750+ credit score might qualify for a 6.5% interest rate, a borrower with a 580 score could see rates in the 7%–9% range. That’s why it’s important to work with a mortgage lender for bad credit who understands how to negotiate the best rate possible for your situation.

At Starr Mortgage Company, we don’t stop at just finding you a loan — we aim to find the best possible loan for you now, with a plan to refinance later. Many homeowners with bad credit refinance to a lower rate once they’ve improved their credit score and built up home equity. It’s part of our long-term strategy to help you save money and build financial stability.

What Are Bad Credit Mortgages?

“Bad credit mortgages” is a term for home loans designed for borrowers who don’t meet the strict requirements of conventional mortgages. A reputable mortgage lender for bad credit will offer products that fit your financial picture while still protecting your future.

These mortgages might include:

- Flexible Credit Requirements: Accepting lower FICO scores.

- Low Down Payment Options: As low as 3.5% for FHA loans.

- Manual Underwriting: Instead of relying on an automated system, your application is reviewed by a real person who can consider factors like rental history, utility payments, or a letter of explanation for past credit issues.

- Alternative Income Verification: For self-employed borrowers or gig workers who don’t have traditional W-2s.

The best part? Bad credit mortgages don’t have to be a lifetime label. Many Starr Mortgage Company clients use these loans as a stepping stone, improving their credit and refinancing within a few years. Our goal is to help you get into a home now — and then help you secure an even better mortgage down the road.

Start Your Homeownership Journey Today

Don’t let a low credit score stand between you and your dream of owning a home. The right mortgage lender for bad credit is out there — and Starr Mortgage Company is here to find them for you.

As your trusted mortgage broker and lender, we believe in second chances and fresh starts. With personalized guidance, flexible loan options, and a team who truly cares, we’ll make the process clear, honest, and achievable.

Ready to take the first step? Contact Starr Mortgage Company today:

- Phone: 845-348-3172

- Email: [email protected]

- Online: https://starrmortgagecompany.com/contact-us/

Your path to homeownership begins here — and your credit score won’t hold you back anymore. Let’s open that front door together!