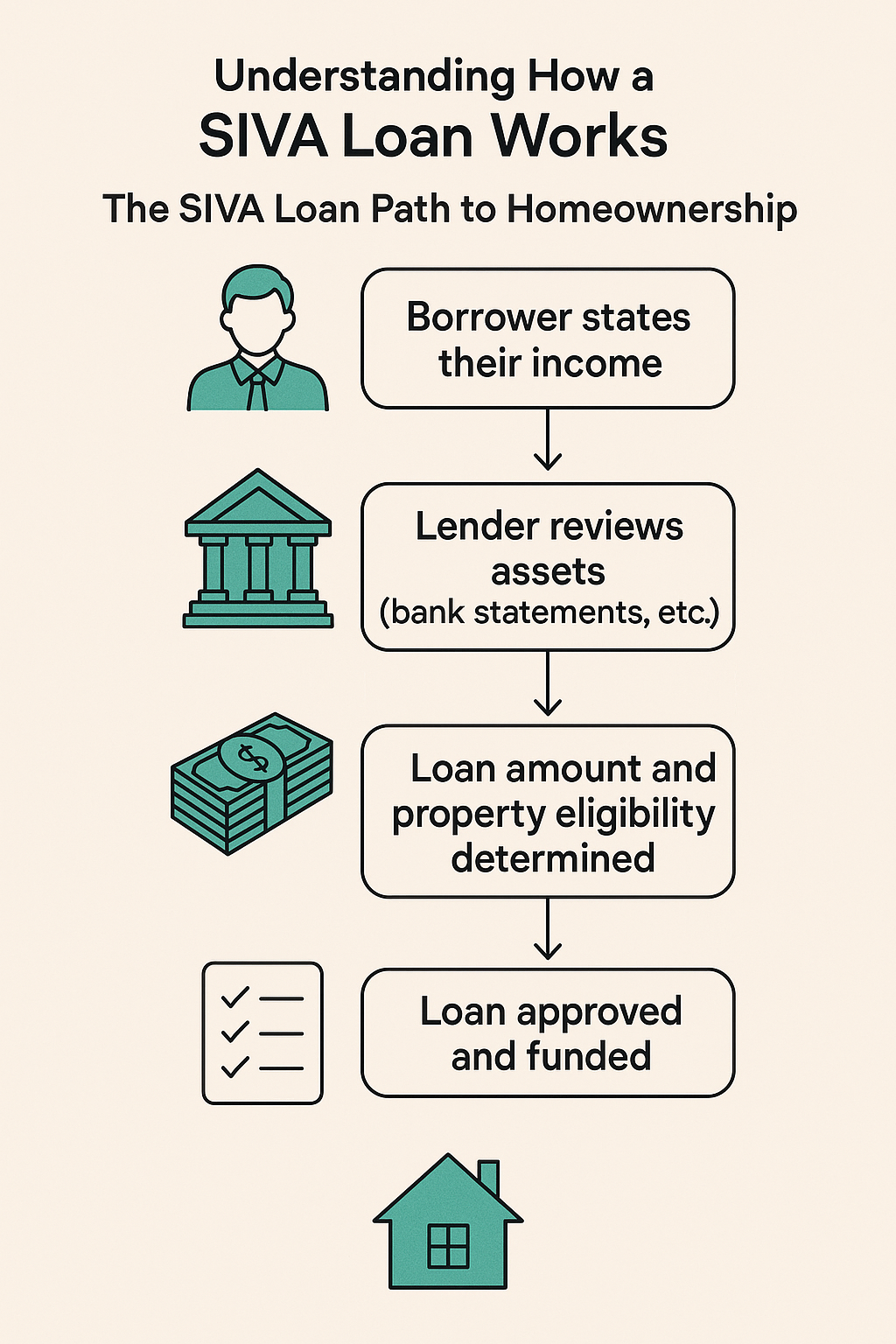

In today’s mortgage landscape, not all borrowers fit the traditional mold of W-2 employees with straightforward income documentation. Many hardworking professionals—entrepreneurs, freelancers, consultants, […]

Category: Loans

Refinancing your home mortgage with one of the best mortgage lenders NYC has to offer can be one of the smartest financial moves […]

Navigating the New York City real estate market is no small feat. From soaring prices to competitive bidding wars, finding an affordable path […]

For many self-employed professionals, entrepreneurs, or investors, proving income through traditional documentation can be challenging—especially when tax returns do not fully reflect financial […]

Not every borrower fits the traditional mortgage mold. If you’re self-employed, retired, or have a non-traditional income stream, qualifying for a standard loan […]

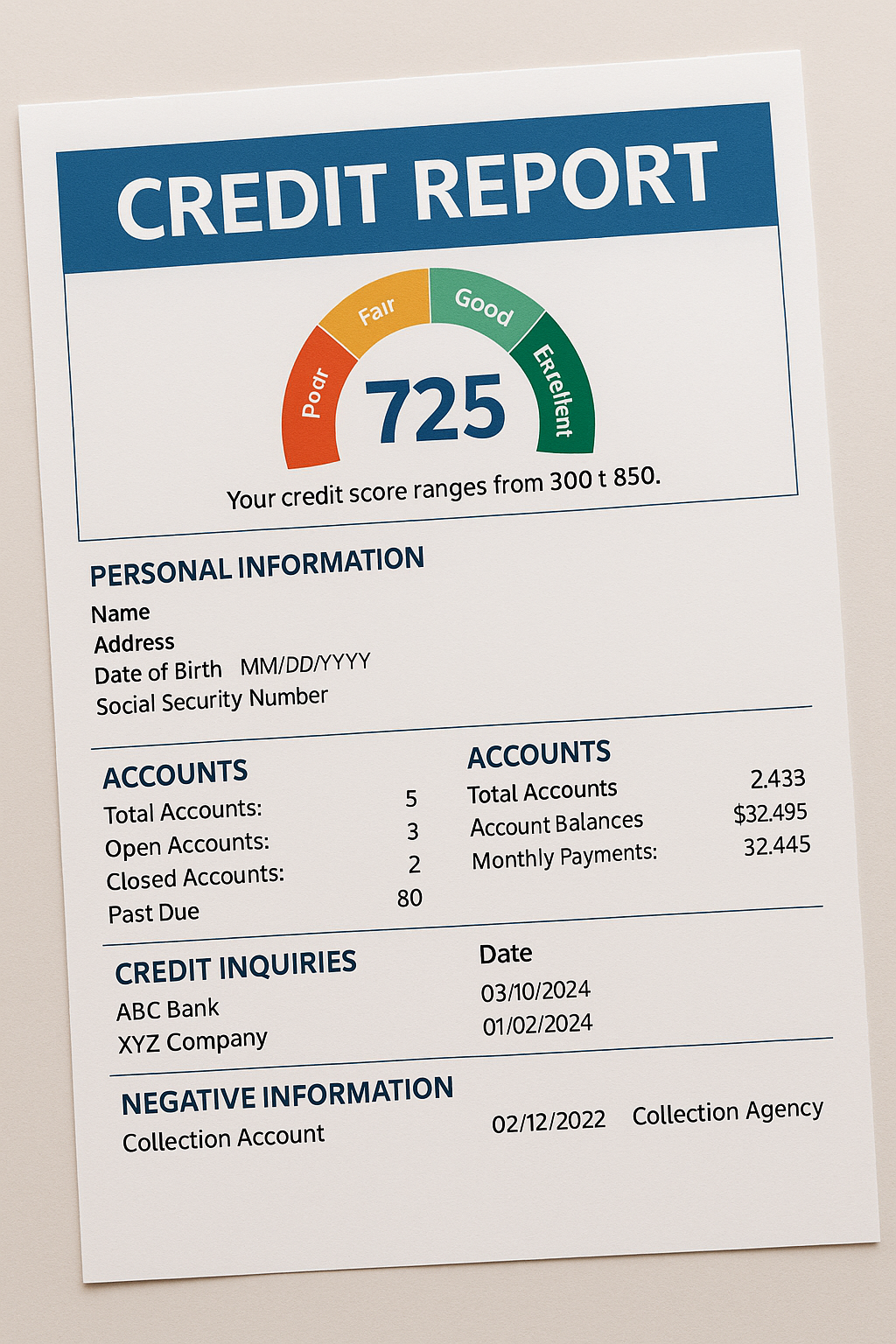

Thinking about buying a home in New York or Westchester County? One of the first questions you’ll face is: What credit score do […]

No income verification home loans are becoming an increasingly popular solution for self-employed buyers who don’t have traditional income documentation. As a self-employed […]

Are you dreaming of homeownership but worried your tax returns might hold you back? Perhaps you’re self-employed with significant write-offs, a real estate […]

Cooperative housing, commonly known as co-ops, offers a unique avenue for homeownership, especially in urban areas like New York City and throughout states […]

If you’re self-employed, obtaining a traditional mortgage can sometimes feel like an uphill battle. Strict requirements for income verification and documentation make it […]